Building and maintaining a positive credit history is pivotal in managing personal finance effectively.

It begins with timely bill payments, as payment history significantly influences credit scores.

Responsibly using credit cards, by keeping balances low and avoiding maxing out limits, also contributes positively. Regularly monitoring your credit report demonstrates to lenders your reliability as a borrower.

Utilize a Personal Finance Software

In the pursuit of managing debt and optimizing credit within personal finance, leveraging technology can be a game-changer.

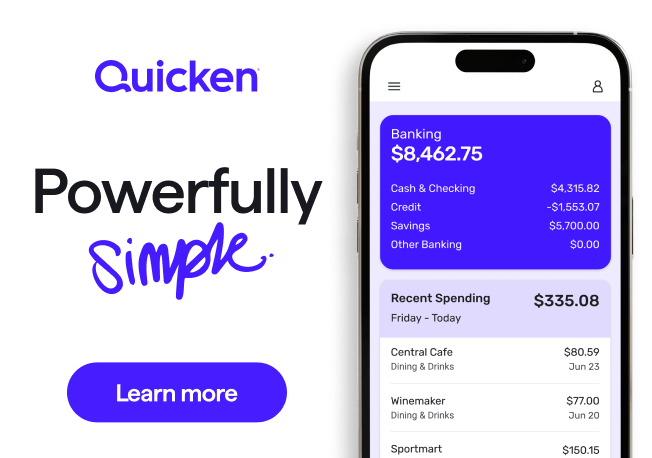

Finance software such as Quicken, offers an integrated platform to monitor debt levels and credit health comprehensively. With Quicken, individuals gain the ability to categorize expenses, set budgeting goals, and visualize financial progress through intuitive dashboards.

This holistic view empowers users to make informed decisions about their debt repayment strategies and credit utilization. Furthermore, Quicken’s detailed reporting tools can help identify spending patterns that may have negative impact to credit scores.

By automating much of the tracking and analysis process, Quicken simplifies personal finance. This enables users to stay focused on their financial objectives without getting overwhelmed by day-to-day transactions.

Debt Repayment Strategies

Debt repayment demands a strategic approach for efficient resolution. Central to this journey is understanding the nature of your debts—identifying high-interest liabilities should be your initial step.

Prioritizing these for repayment not only reduces the amount paid over time but also accelerates your path to financial freedom. Additionally, exploring consolidation options can simplify your debt landscape, potentially lowering interest rates and monthly payments.

This balanced strategy ensures that you’re not just fighting fires, but building a resilient financial future.

The Importance Of An Emergency Fund

The cornerstone of personal financei s the establishment of an emergency fund.

This financial buffer serves as a safeguard against the unforeseen, such as medical emergencies, sudden job loss, or urgent car repairs. Without this safety net, individuals may find themselves compelled to rely on high-interest credit options or loans, exacerbating their financial burdens and propelling them further into debt.

An emergency fund provides peace of mind and also enhances financial stability by offering a fallback that doesn’t derail one’s long-term fiscal goals. Therefore, prioritizing the creation and maintenance of an emergency fund is essential for anyone looking to navigate personal finance successfully.

Thank you for reading this post, don't forget to subscribe to our newsletter!